tax on venmo over 600

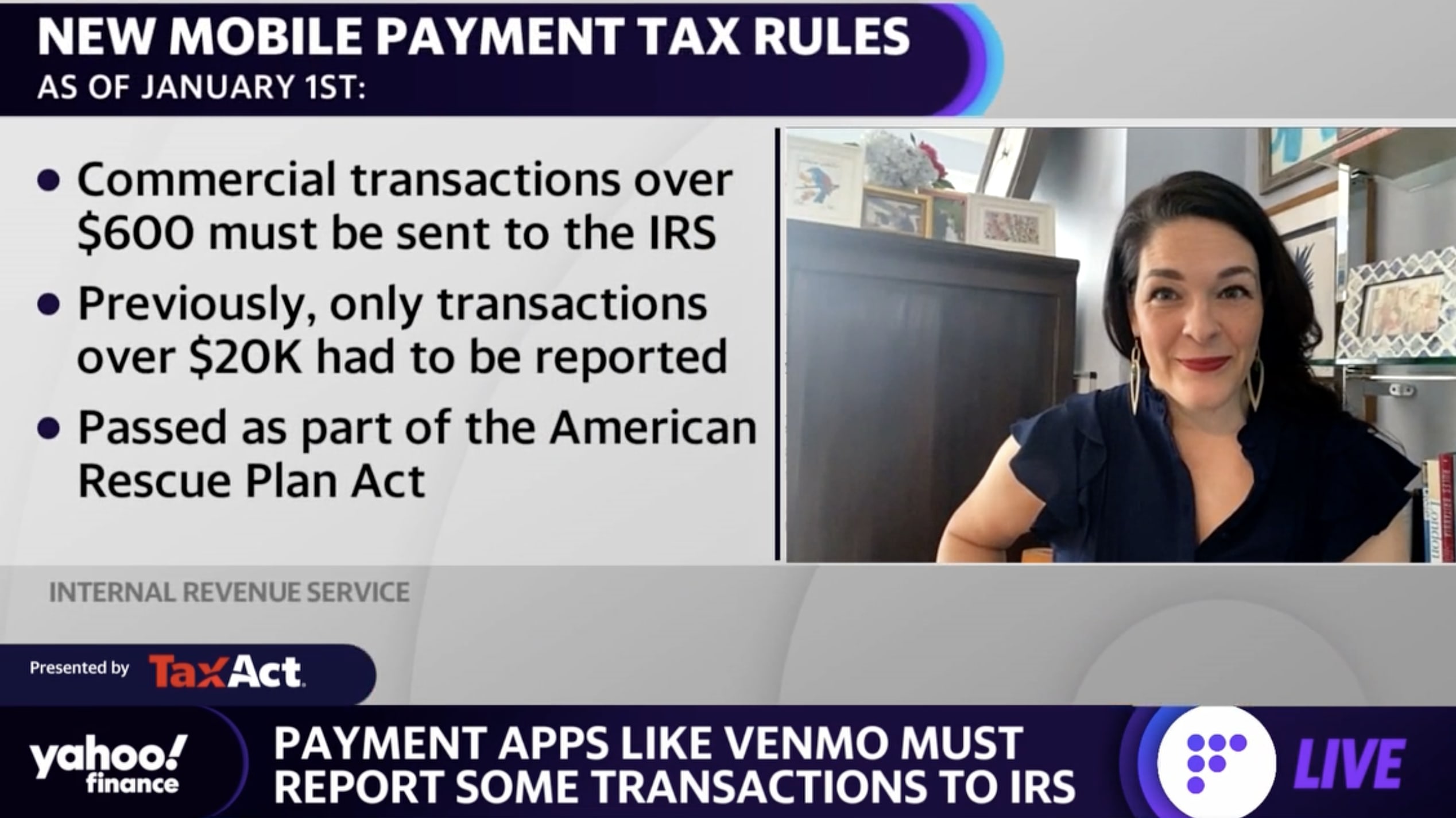

If your Venmo or CashApp transactions exceed 600 and qualify as taxable income you will likely be sent a 1099-K by the IRS to fill out. Previously a 1099-K would only be sent to those who earned over 20000 and had more than 200 payment transactions.

New Tax Law Requires Cash Apps Report Transactions Of 600 To The Irs Venmo Paypal Zelle Apple Pay Youtube

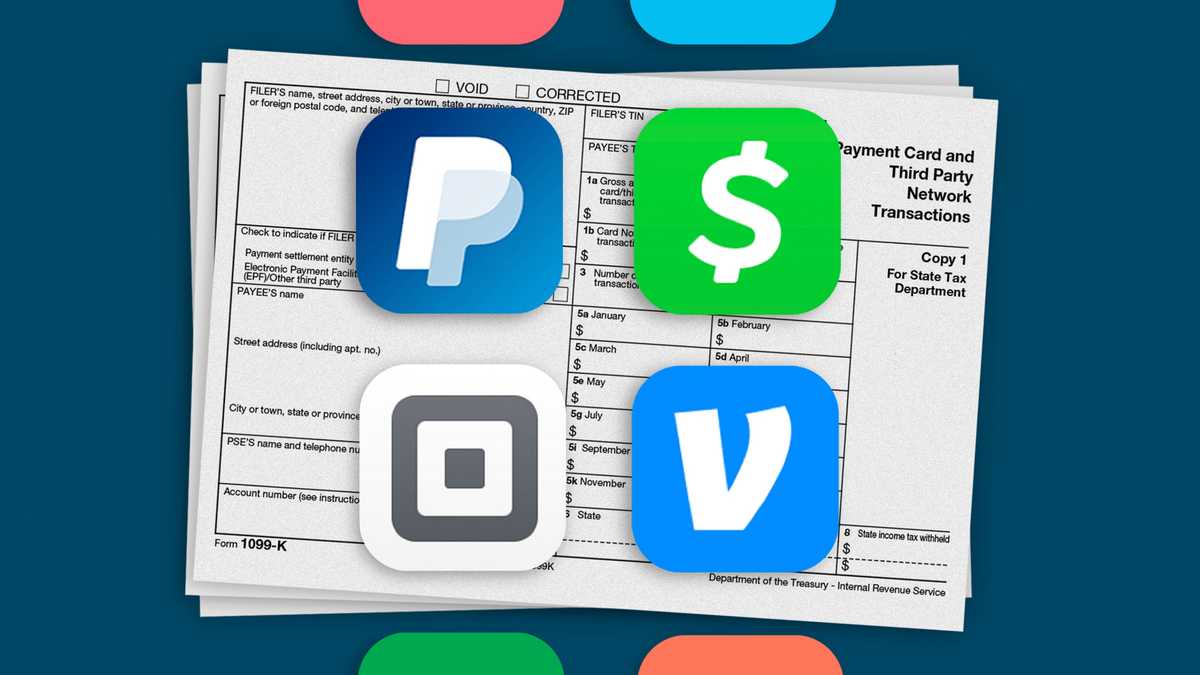

Third-party payment processors like Venmo PayPal and Cash App are now required to report a users business transaction to the IRS if they exceed 600 for the year.

. In prior years the 1099-K would have been sent out if your total. Prior to this legislation third-party payment platforms would only report to the tax agency if a user had more than 200 commercial transactions and made more than 20000 in payments over the. If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the IRS.

There has been a flurry of furious cash app users this past week angrily responding to rumors of President Joe Bidens new tax reporting plan. To be clear this new regulation does not add a new tax. Starting this month users selling goods and services through such popular sites as Venmo Etsy and Airbnb will begin receiving tax forms if they take a.

Currently online sellers only received these forms if they had at least. If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the IRS. According to FOX Business.

Under the American Rescue Plan Act people who sell goods or services on platforms like Etsy eBay and other sites that use third-party transaction networks like PayPal Cash App and Venmo will be issued a tax form called a 1099-K for online sales totaling 600 or more starting next year. But users were largely mistaken to believe the change applied to them. Any income you make over 600 is now being reported to the Internal Revenue Service by payment apps including eBay Venmo and Airbnb.

This does not mean that you will automatically be taxed morethe IRS simply wants to ensure that businesses are being held accountable for their earnings across all channels. WJBF A change from the IRS may complicate next tax season for small business owners who use apps like Venmo or PayPal. No Venmo isnt going to tax you if you receive more than 600.

Now the IRS did. The person receiving the money warns that starting next year any payments over 600 will be subject to tax by the IRS. Individual states have their own rules for state income taxes in Maryland for instance the amount is also 600 in gross payment volume.

The new rule which affects tax year 2022 and beyond has lowered this amount to 600. This applies to those who have a business and are set up to accept payment cards or payments from a third-party settlement organization then you will receive a Form 1099-K but only if the aggregate amount of payments for goods and services exceeds 600 during the calendar year. Buried deep in the COVID relief law that Democrats rammed through last March is a provision forcing Venmo PayPal and other third-party payment services to send the IRS details on anyone who.

The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. The new law which is in effect for. If you go out to dinner with a friend and you Venmo them your part of the bill youre not going to be taxed.

If your Venmo or CashApp transactions exceed 600 and qualify as taxable income you will likely be sent a 1099-K by the IRS to fill out. 1 the Internal Revenue Service IRS requires reporting of payment transactions via apps such as Venmo PayPal Stripe and Square for goods and services sold which meet or exceed 600. If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the IRS.

As of Jan. The IRS is cracking down on the apps to make sure everyone is paying their fair share of taxes. Business Venmo transactions over 600 taxed.

If you receive over 600 in income through these sources you will receive a Form 1099-K and a duplicate form will also be sent to the IRS. This new rule does not apply to payments received for personal expenses. Those posts refer to a provision in the American Rescue Plan Act which went.

Side hustlers beware. The new rules simply make sure that this income is reported. Social media posts like this tweet that was published on September 15 have claimed that starting January 2022 if you receive more than 600 per year through third-party peer-to-peer payment apps like Cash App Venmo or Zelle you will be taxed on those transactions.

Payments of 600 or more through third-party payment networks like Venmo Cash App or Zelle will now be reported to the IRS. Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year. Anyone who receives at least 600 in payments for goods and services through Venmo or any other payment app can expect to receive a Form 1099-K.

While Venmo is required to send this form to qualifying users its worth. You will pay taxes on any portion of funds considered taxable income.

Venmo Cash App Paypal To Report Transactions Of 600 Or More To Irs Marketplace

Venmo And Paypal Will Now Share Your Transactions With The Irs If You Make More Than 600 A Year On The Platforms The Washington Post

Afraid The Irs Will Tax Your Venmo Paypal Or Other Payment App Transactions Here S What You Should Do The Washington Post

New Tax Rule Requires Paypal Venmo Cash App To Report Annual Business Payments Exceeding 600

Tax Day Venmo And Paypal Users Face More Paperwork Under New Us Rules Us News The Guardian

/arc-goldfish-cmg-thumbnails.s3.amazonaws.com/01-05-2022/t_922560b2db1b4cd3a10b798a2d631ae6_name_Venmo_Paypal_must_report_payments_of_600_61d595b2283c07051d1095e4_1_Jan_05_2022_13_11_02_poster.jpg)

Venmo Paypal Cash App Must Report Payments Of 600 Or More To Irs Wftv

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

/how-safe-venmo-and-why-it-free_FINAL-d6b7c0672d534208a05d1d53ae0cd915.png)

How Safe Is Venmo And What Are Its Fees

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

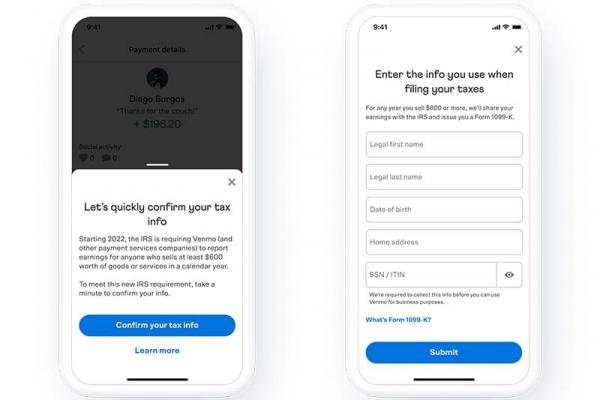

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

Taxes What To Know About Irs Changes For Payment Apps Like Venmo Paypal

Venmo Paypal And Cash App To Report Payments Of 600 Or More To Irs This Year What To Know Larson Accouting

Federal Government To Ask For Taxes On App Transactions Over 600

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

New Tax Law Venmo Cash App To Report Business Transactions Over 600 Wrvo Public Media

What To Know About The Irs New Reporting Requirements For Venmo Paypal And Other Payment Apps

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You 6abc Philadelphia